Table of contents

Birch Plywood Vietnam Supplier: Why European Buyers Are Shifting from China to Vietnam | HCPLY – Vietnam Plywood

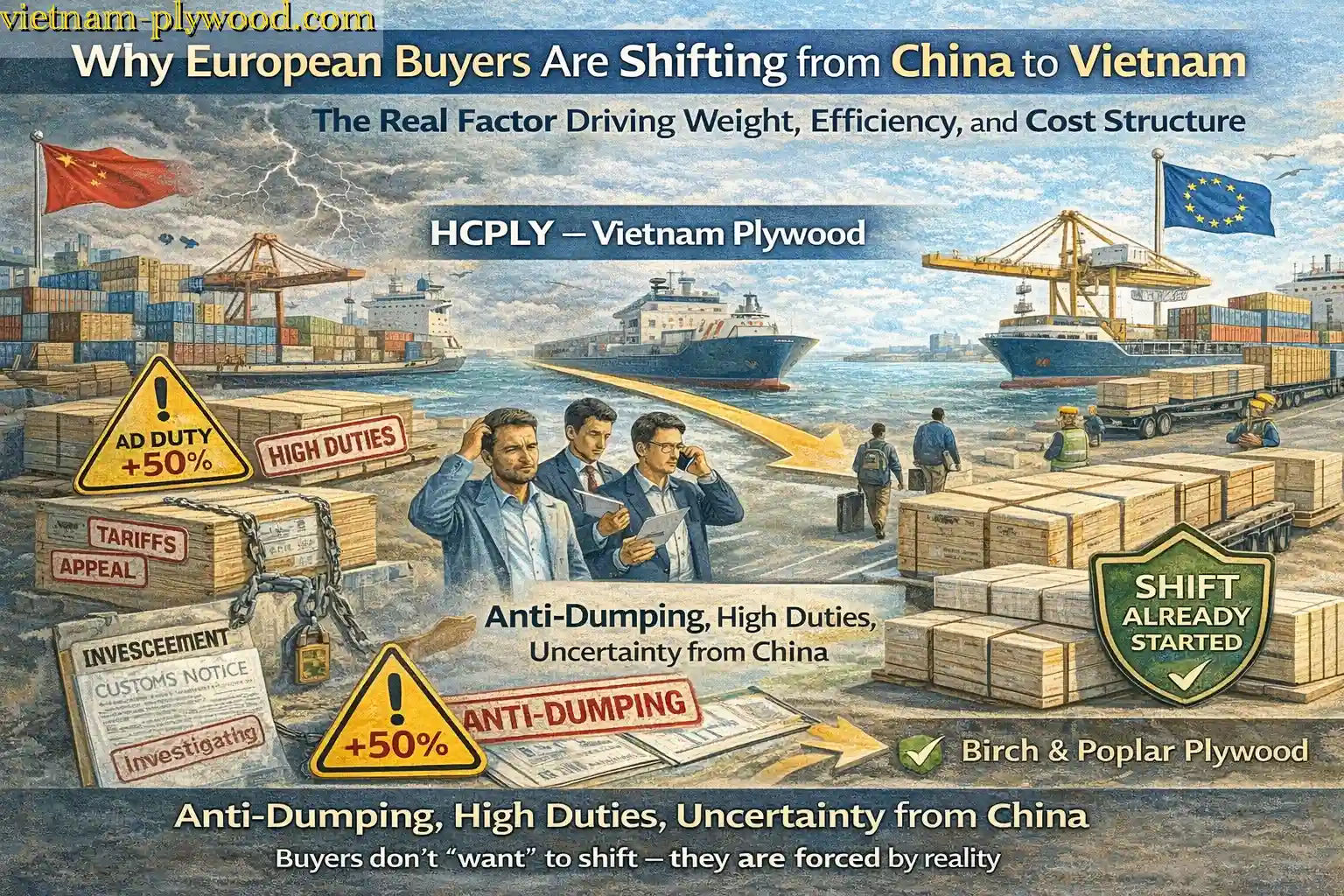

European plywood buyers are standing at a turning point.

For years, China was the default sourcing destination for birch plywood, poplar plywood, and engineered panels. But rising anti-dumping duties, unstable pricing, inconsistent quality, and increasing compliance risks have forced buyers to rethink everything they thought they knew about plywood sourcing. Today, the question is no longer whether to move away from China — but where to move next.

This is where Vietnam has emerged as the strategic alternative, and where HCPLY – Vietnam Plywood plays a decisive role.

As a leading birch plywood Vietnam supplier, HCPLY – Vietnam Plywood is not a trading company, not an intermediary, and not a short-term opportunist. We are a large-scale plywood manufacturer, supplier, and exporter, operating with stable factory capacity, controlled raw material sourcing, and production systems designed specifically for European buyers who demand consistency, compliance, and long-term supply security.

Behind every panel we export lies a complete manufacturing ecosystem — from core veneer preparation and adhesive formulation to hot pressing, sanding, quality control, and container loading optimization. This factory-first mindset allows HCPLY – Vietnam Plywood to deliver what many buyers can no longer reliably source from China: stable birch plywood, predictable poplar plywood, and export-grade panels at competitive prices — without compromising compliance or performance.

In the sections below, we will break down why European buyers are shifting from China to Vietnam, how birch plywood Vietnam supplier advantages translate into real commercial value, and why HCPLY – Vietnam Plywood stands at the center of this structural transition in the global plywood supply chain.

🔵 ① The Shift Has Already Started — And Buyers Did Not Choose It

European plywood buyers are not witnessing a trend — they are living through a forced transition.

For more than a decade, China dominated global sourcing for birch plywood and poplar plywood. Volumes were massive, prices were competitive, and supply chains appeared stable enough for long-term planning. Entire furniture programs, retail collections, and OEM contracts were built around Chinese supply.

That model has already broken.

Today, European buyers are not choosing to leave China.

They are being pushed out by structural risk.

🔴 Anti-dumping investigations are expanding across multiple EU markets

🔴 Import duties increase unpredictably, sometimes retroactively

🔴 Customs clearance has become slower, stricter, and legally exposed

🔴 Compliance requirements now extend far beyond basic documentation

🔴 Final landed cost is no longer controllable at booking stage

The real damage is not price — it is uncertainty.

Uncertainty destroys sourcing models faster than any cost increase ever could.

Furniture brands lose margin visibility.

Importers lose contract stability.

OEM factories cannot guarantee delivery schedules to their own clients.

This is why the most common message European buyers express today is not:

“China is too expensive.”

It is:

“China is no longer predictable.”

And predictability is the foundation of professional plywood sourcing.

As risk accumulates, buyers are forced to redesign their supply chains — not for the lowest short-term price, but for legal safety, cost stability, and continuity of supply.

This is exactly where Vietnam has emerged — not as a temporary alternative, but as a strategic manufacturing destination built around plantation timber, factory-scale production, and an export-first mindset aligned with EU requirements.

At the center of this shift stands HCPLY – Vietnam Plywood — a leading plywood manufacturer, supplier, and exporter with large-scale factory capacity, controlled raw material sourcing, and production systems designed specifically for European buyers.

Unlike trading-based supply chains, HCPLY – Vietnam Plywood operates with:

- ✔️ Factory-controlled birch plywood and poplar plywood production

- ✔️ Plantation-based raw materials with traceable origin

- ✔️ Stable capacity planning for long-term contracts

- ✔️ EU-oriented compliance systems

- ✔️ Competitive pricing without legal volatility

The shift has already started.

The only remaining risk for European buyers is waiting too long — and discovering that reliable factory capacity in Vietnam has already been secured by competitors.

In the next section, we will explain what fundamentally changed in global plywood sourcing, and why China’s model no longer aligns with European risk tolerance — while Vietnam’s manufacturing structure does.

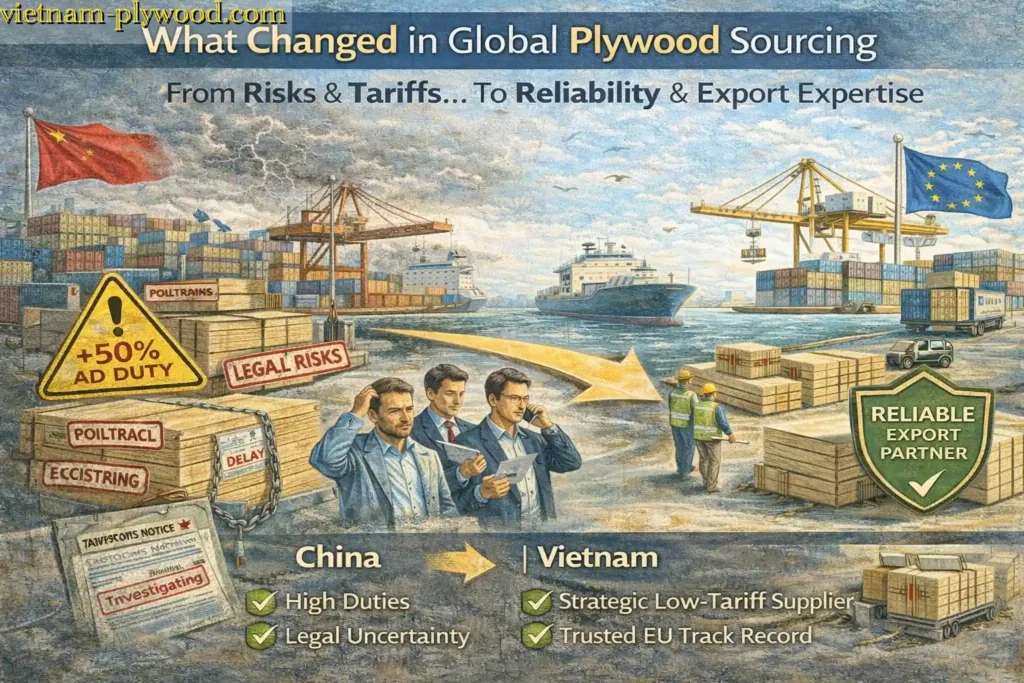

🔵 ② What Changed in Global Plywood Sourcing — And Why China’s Model No Longer Works

For European plywood buyers, the shift away from China did not happen overnight.

It was the result of structural changes in the global sourcing environment — changes that quietly accumulated until the old model stopped working.

For years, China operated as the world’s plywood workshop.

Massive capacity, aggressive pricing, fast turnaround — this model suited buyers who prioritized volume and short-term cost efficiency.

That environment no longer exists.

China: Rising Risk Instead of Rising Efficiency

China’s plywood export model is now under pressure from multiple directions at once:

- Anti-dumping duties targeting plywood and wood-based panels continue to expand across EU markets

- Import tariffs fluctuate unpredictably, sometimes applied retroactively

- Customs inspections have become stricter, slower, and more documentation-heavy

- Legal exposure has increased for European importers tied to Chinese supply chains

- Compliance standards now extend far beyond basic certificates and invoices

The critical issue is not that China cannot produce plywood.

It is that European buyers can no longer control risk, cost, and predictability at the same time.

What used to be a sourcing advantage has become a liability.

Vietnam: From Alternative to Strategic Manufacturing Hub

While China’s model became heavier and riskier, Vietnam quietly evolved in the opposite direction.

Vietnam’s plywood industry is built on fundamentally different foundations:

- Plantation-based timber instead of imported or mixed-origin raw materials

- Factory-scale manufacturing, not fragmented subcontracting

- Export-oriented production systems designed around EU and US standards

- Long-term buyer relationships, not spot trading

Instead of chasing volume at any cost, Vietnamese manufacturers optimized for:

- Compliance stability

- Traceable raw material sourcing

- Predictable production planning

- Contract-based supply instead of speculative trading

This is why Vietnam is no longer viewed as a “backup option.”

It is now a strategic sourcing destination.

The Structural Difference Buyers Must Understand

The global plywood market did not simply “shift.”

It restructured.

China’s model prioritized:

- Speed

- Scale

- Price competition

Vietnam’s model prioritizes:

- Control

- Compliance

- Continuity of supply

For European buyers operating under tighter regulations, stricter ESG scrutiny, and thinner margin tolerance, the second model is no longer optional — it is necessary.

This structural realignment explains why Vietnam has become the focal point for buyers sourcing birch plywood and poplar plywood, especially for furniture, interior panels, and OEM programs that demand stability over speculation.

In the next section, we will look at why birch plywood and poplar plywood are the two product categories most affected by this shift — and why their supply chains reacted faster than others.

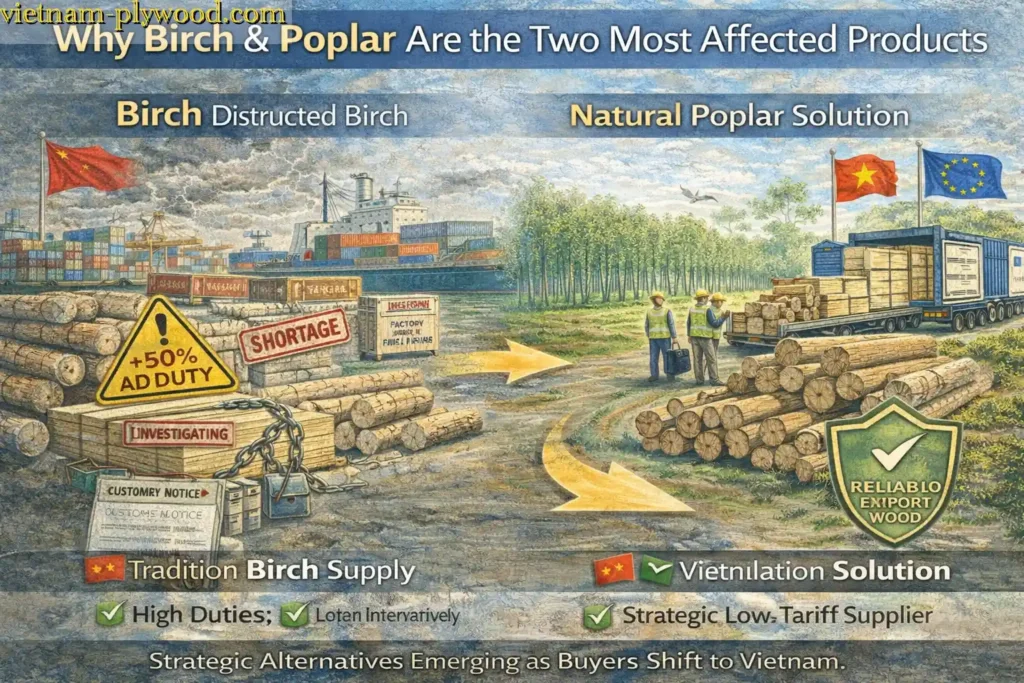

🔵 ③ Why Birch Plywood and Poplar Plywood Were Hit First — And Why Buyers Reacted Faster Than Expected

Not all plywood categories reacted equally to the global sourcing shift away from China.

Birch plywood and poplar plywood were the first to feel the pressure — and the fastest to move.

The reason is simple: these two product lines sit at the intersection of cost sensitivity, compliance exposure, and performance expectation for European buyers.

Birch Plywood: High Expectation, Zero Margin for Risk

Birch plywood has always been positioned as a premium material in Europe.

Furniture manufacturers, cabinet makers, and interior brands rely on birch plywood not just for strength, but for surface stability, machining accuracy, and long-term consistency. Any disruption in quality immediately translates into rejected panels, production delays, or brand damage.

When anti-dumping risks, customs delays, and documentation uncertainty began to affect Chinese birch plywood, European buyers faced an uncomfortable reality:

They could no longer absorb risk inside a premium product category.

A single shipment delay or compliance issue in birch plywood does not just affect cost — it interrupts entire furniture programs and OEM supply chains.

This is why birch plywood buyers reacted first.

And this is exactly where Vietnam stepped in.

As a birch plywood Vietnam supplier, HCPLY – Vietnam Plywood provides a structurally different solution:

✔️ Birch face veneer combined with controlled, plantation-based core

✔️ Stable thickness tolerance and sanding quality for CNC and finishing

✔️ EU-oriented glue systems (CARB P2 / E0 / E1 options)

✔️ Factory-scale consistency suitable for long-term contracts

For European buyers, this was not a downgrade.

It was a risk-neutral replacement.

Poplar Plywood: Cost Control Meets Compliance Pressure

Poplar plywood followed quickly behind.

Unlike birch, poplar plywood competes primarily on cost efficiency, weight control, and processing flexibility. It is widely used in furniture frames, interior panels, packaging components, and laminated boards.

Chinese poplar plywood used to dominate this segment.

But once compliance risk and unpredictable landed cost entered the equation, poplar plywood buyers faced a different — but equally serious — problem:

Margins disappeared.

Poplar plywood buyers operate on thin spreads. Any retroactive duty, delayed clearance, or re-inspection can erase profitability entirely.

Vietnam’s poplar plywood manufacturing model — based on plantation timber, stable labor cost, and export-oriented production — offered exactly what this segment needed:

✔️ Predictable cost structure

✔️ Lightweight, uniform panels

✔️ Stable core construction for lamination

✔️ Compliance-aligned documentation

At HCPLY – Vietnam Plywood, poplar plywood is not treated as a low-end product.

It is engineered for volume stability, processing reliability, and container optimization — exactly what European buyers require when scaling production outside China.

Why These Two Categories Moved First

Birch plywood and poplar plywood were the first to shift because they expose risk immediately.

There is no buffer.

No alternative material inside the same production cycle.

No flexibility to “wait and see.”

Once uncertainty entered Chinese supply chains, buyers had only two choices:

Absorb risk — or redesign sourcing.

They chose the second.

This is why Vietnam’s role expanded so quickly — and why HCPLY – Vietnam Plywood became a reference supplier for European buyers seeking continuity, not experimentation.

In the next section, we will explain why HCPLY’s factory-based model matters more than country-of-origin alone, and how manufacturing structure — not nationality — determines whether a supplier can truly replace China at scale.

🔵 ④ Vietnam’s Manufacturing Advantage Explained — Why Factories Matter More Than Country Name

As European buyers move away from China, one misunderstanding appears again and again:

Vietnam is not the advantage — manufacturing structure is.

Vietnam succeeds where China now struggles because its plywood industry is built on a fundamentally different production logic. This difference becomes critical when buyers scale birch plywood and poplar plywood sourcing under EU compliance pressure.

🌱 Plantation Wood: The Foundation of Supply Stability

Vietnam’s plywood industry is rooted in plantation-based timber, not mixed-origin or imported raw materials.

This single factor changes everything.

At HCPLY – Vietnam Plywood, core veneer and face veneer sourcing is based on:

- ✔️ Legally planted, short-rotation species

- ✔️ Stable domestic supply chains

- ✔️ Traceable origin aligned with EUTR / EUDR expectations

- ✔️ Predictable cost structure without geopolitical shocks

Plantation sourcing allows HCPLY – Vietnam Plywood to plan production months ahead — not shipment by shipment. This is impossible in sourcing models dependent on imported logs or unstable raw material origins.

👉 Related factory-controlled raw material system:

https://vietnam-plywood.com/core-veneer-vietnam/

🏭 Factory-Scale Production: Control Replaces Guesswork

Vietnam’s advantage is not small workshops.

It is factory-scale manufacturing with centralized control.

HCPLY – Vietnam Plywood operates as a large-scale plywood manufacturer, supplier, and exporter, controlling every critical step:

- Core veneer selection & drying

- Glue formulation & bonding systems

- Hot pressing & thickness calibration

- Sanding, grading & surface control

- Container loading & export optimization

This factory-based model delivers what European buyers lost in China:

- Consistency across batches

- Repeatable quality across contracts

- Stable lead times

- Predictable specifications

Trading-based supply chains cannot offer this — regardless of country.

🚢 Export Mindset: Built for Europe, Not Domestic Dumping

Vietnamese factories that succeed in Europe are built for export from day one.

At HCPLY – Vietnam Plywood, production is designed around:

- ✔️ European thickness tolerance expectations

- ✔️ CNC and furniture-grade processing requirements

- ✔️ EU glue standards (E0 / E1 / CARB P2 options)

- ✔️ Long-term contract supply, not spot pricing

This export-first mindset explains why HCPLY – Vietnam Plywood supplies:

- Birch plywood for European furniture brands

- Poplar plywood for interior and OEM applications

- Film faced plywood for regulated construction markets

👉 Example export-grade product lines:

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Film faced plywood Vietnam: https://vietnam-plywood.com/film-faced-plywood-vietnam/

🔑 The Key Lesson for Buyers

Country-of-origin alone does not replace China.

Manufacturing structure does.

Vietnam works because its leading suppliers are:

- Manufacturers, not traders

- Factory operators, not brokers

- Export specialists, not opportunists

This is why buyers who choose real factories succeed — and those who follow trading shortcuts repeat the same mistakes they are trying to escape.

In the next section, we will place China and Vietnam side by side and break down the real differences that matter to European buyers, using a clear comparison table focused on tax exposure, compliance risk, flexibility, and MOQ reality.

🔵 ⑤ China vs Vietnam — Core Differences That Decide Buyer Survival

When European buyers compare China and Vietnam today, the discussion is no longer about unit price per CBM.

It is about risk exposure, compliance control, flexibility, and long-term sourcing viability.

Below is a clear, factory-level comparison based on real export experience from HCPLY – Vietnam Plywood, a large-scale plywood manufacturer, supplier, and exporter serving European markets.

📊 China vs Vietnam — What Really Changes for Buyers

| Critical Factor | China Plywood Supply | Vietnam Plywood Supply (HCPLY – Vietnam Plywood) |

|---|---|---|

| Import Duties & Anti-dumping | ❌ High risk, unpredictable, often retroactive | ✅ Stable duty environment, lower legal exposure |

| Compliance & Documentation | ❌ Increasingly complex, high audit pressure | ✅ Plantation-based, traceable, EU-aligned |

| Supply Chain Control | ❌ Fragmented, trader-dependent | ✅ Factory-controlled from veneer to container |

| MOQ Flexibility | ❌ Large MOQ, low customization | ✅ Flexible MOQ for EU buyers |

| Specification Stability | ❌ Batch variation common | ✅ Consistent specs across contracts |

| Lead Time Predictability | ❌ Disrupted by inspections & controls | ✅ Planned production & stable schedules |

| Long-term Contract Suitability | ❌ High risk | ✅ Designed for long-term supply |

⚠️ Why These Differences Matter More Than Price

European buyers sourcing birch plywood and poplar plywood operate under:

- Tight margin control

- Fixed delivery commitments

- Increasing legal responsibility

In this environment, a supplier that cannot guarantee compliance stability becomes a liability — even if the FOB price looks attractive.

China’s model struggles because it was built for:

- Speed

- Volume

- Short-term price competition

Vietnam’s model succeeds because it is built for:

- Control

- Transparency

- Contract-based export supply

🏭 Why Factory-Controlled Supply Wins

At HCPLY – Vietnam Plywood, the difference is structural, not promotional.

As a direct manufacturer, supplier, and exporter, HCPLY controls:

- ✔️ Core veneer production and grading

- ✔️ Glue systems and bonding performance

- ✔️ Pressing, sanding, and thickness tolerance

- ✔️ Final QC before container loading

This eliminates the uncertainty European buyers face when working through trading layers.

🎯 The Buyer Reality

European buyers who continue to compare China vs Vietnam purely on price repeat the same mistake that forced them to move in the first place.

The buyers who succeed compare:

- Risk vs stability

- Compliance vs exposure

- Control vs dependency

This is why factory-based Vietnamese suppliers — especially HCPLY – Vietnam Plywood — are replacing China not just as an alternative, but as a new sourcing foundation.

In the next section, we will explain why traders fail and factories win, and why choosing the wrong type of supplier in Vietnam can recreate the same problems buyers are trying to escape.

🔵 ⑥ Why Traders Fail — And Why Factories Win Every Time

When European buyers decide to leave China and shift sourcing to Vietnam, many assume the biggest risk is country selection.

In reality, the biggest risk is choosing the wrong type of supplier.

Vietnam does not eliminate risk automatically.

Only factory-controlled manufacturing does.

❌ The Trader Model: Same Risks, New Location

Many buyers unknowingly recreate their China problems in Vietnam by working with traders instead of manufacturers.

Trading companies typically:

- ❌ Do not own factories

- ❌ Do not control core veneer production

- ❌ Do not manage glue formulation or pressing parameters

- ❌ Do not control batch consistency

- ❌ Rely on multiple subcontracted mills

As a result, buyers face:

- Inconsistent core composition

- Mixed or undocumented raw material origin

- Variable thickness tolerance

- Unstable bonding performance

- No accountability when issues appear

The trader model survives on price negotiation, not production control.

And under EU scrutiny, this model collapses quickly.

🏭 The Factory Model: Control Replaces Promises

At HCPLY – Vietnam Plywood, the difference is structural.

We are not an intermediary.

We are a large-scale plywood manufacturer, supplier, and exporter, operating with direct factory ownership and centralized production control.

HCPLY – Vietnam Plywood controls:

- ✔️ Core veneer sourcing from plantation timber

- ✔️ Veneer drying and grading standards

- ✔️ Glue systems tailored for EU markets

- ✔️ Hot pressing pressure and cycle control

- ✔️ Sanding precision and surface calibration

- ✔️ Final inspection before container sealing

This means buyers receive the same panel today, next month, and next year.

📊 Trader vs Factory — The Real Difference for Buyers

| Key Factor | Trader-Based Supply | Factory-Based Supply (HCPLY – Vietnam Plywood) |

|---|---|---|

| Core Veneer Control | ❌ None | ✅ Full control |

| Raw Material Traceability | ❌ Unclear | ✅ Plantation-based, documented |

| Quality Consistency | ❌ Varies by batch | ✅ Stable across contracts |

| Compliance Responsibility | ❌ Shifted to buyer | ✅ Shared & documented |

| Problem Resolution | ❌ Negotiation | ✅ Technical correction |

| Long-Term Contracts | ❌ High risk | ✅ Designed for continuity |

🎯 Why This Matters More After China

When sourcing from China, many buyers tolerated traders because:

- Volume was abundant

- Cost advantages absorbed inefficiency

- Compliance pressure was lower

That environment no longer exists.

Today, European buyers must prove:

- Legal sourcing

- Product consistency

- Documented compliance

- Predictable landed cost

Only factories can support this responsibility.

🏆 Why European Buyers Choose HCPLY – Vietnam Plywood

Buyers working with HCPLY – Vietnam Plywood are not buying panels.

They are buying:

- A controlled manufacturing system

- A stable production partner

- A scalable export platform

- A compliant supply chain

This is why traders fail during structural shifts — and factories like HCPLY – Vietnam Plywood become long-term suppliers.

In the next section, we will explain how HCPLY – Vietnam Plywood fits perfectly into this China-to-Vietnam transition, and why European buyers view our factory not as an alternative — but as a new foundation.

🔵 ⑦ How HCPLY – Vietnam Plywood Fits This Shift — Factory Power Replaces Supply Risk

When European buyers move away from China, they are not just changing geography.

They are rebuilding their supply model.

This is exactly where HCPLY – Vietnam Plywood fits — not as an alternative supplier, but as a structural replacement for the old China-dependent system.

🏭 A Direct Manufacturer — Not a Trading Layer

HCPLY – Vietnam Plywood is a large-scale plywood manufacturer, supplier, and exporter based in Vietnam, operating with direct factory ownership and export-focused production.

This matters because:

- ✔️ There is no trader margin distorting cost structure

- ✔️ There is no subcontracted mill changing specifications

- ✔️ There is no gap between promise and production

European buyers work directly with the factory — the same team that controls raw materials, production lines, quality systems, and container loading.

🌱 Controlled Raw Material Sourcing at Scale

One of the biggest failures of China-based sourcing today is raw material uncertainty.

At HCPLY – Vietnam Plywood, production is built on plantation-based timber systems, not mixed or speculative sourcing.

Factory control includes:

- ✔️ Core veneer preparation from plantation wood

- ✔️ Stable poplar, eucalyptus, and mixed hardwood cores

- ✔️ Birch face veneer applied under controlled bonding conditions

- ✔️ Documented sourcing aligned with EU expectations

👉 Core veneer system overview:

https://vietnam-plywood.com/core-veneer-vietnam/

This allows HCPLY – Vietnam Plywood to offer predictable cost, stable quality, and documented compliance — even under tightening EU regulations.

📦 Product Lines Designed for European Buyers

HCPLY – Vietnam Plywood does not produce “generic plywood.”

We manufacture export-grade panels engineered for European applications, including:

- Birch plywood Vietnam

https://vietnam-plywood.com/birch-plywood-vietnam/ - Poplar plywood Vietnam

https://vietnam-plywood.com/poplar-plywood-vietnam/ - Film faced plywood for regulated construction

https://vietnam-plywood.com/film-faced-plywood-vietnam/ - Eucalyptus plywood for strength-focused applications

https://vietnam-plywood.com/eucalyptus-plywood-vietnam/

Each product line is manufactured with:

- Consistent thickness tolerance

- Stable core composition

- EU-oriented glue options (E0 / E1 / CARB P2)

- Container loading optimized for cost efficiency

🚢 Export Experience That Reduces Buyer Risk

HCPLY – Vietnam Plywood is not new to Europe.

As an established exporter, we understand:

- European buyer documentation requirements

- Contract-based supply expectations

- Long-term program stability

- Margin sensitivity under fixed-price agreements

This export mindset means buyers are not “testing Vietnam.”

They are operating Vietnam at scale.

🎯 Why European Buyers Choose HCPLY – Vietnam Plywood

European buyers shifting from China choose HCPLY – Vietnam Plywood because we offer:

- ✔️ Factory-scale production capacity

- ✔️ Stable long-term supply planning

- ✔️ Competitive pricing without legal volatility

- ✔️ Transparent manufacturing, not trading descriptions

- ✔️ A supplier that can grow with their business

In short, HCPLY – Vietnam Plywood does not sell plywood panels.

We deliver supply continuity.

In the next section, we will identify which buyer profiles are most likely to shift first, and why furniture brands, importers, and OEM factories are moving faster than others.

🔵 ⑧ Buyer Profiles Most Likely to Shift — Who Is Moving First and Why

The shift from China to Vietnam is not happening evenly across all buyers.

It is led by professional buyers with real exposure, not opportunistic traders.

Based on export data, inquiries, and long-term contracts at HCPLY – Vietnam Plywood, three buyer profiles are moving first — and moving decisively.

🪑 Furniture Brands: Margin Protection Comes First

European furniture brands are under pressure from all directions:

- Fixed retail pricing

- Rising logistics cost

- Stricter compliance requirements

- Zero tolerance for production delays

For these buyers, sourcing failure is not an option.

They shift to Vietnam because:

- ❌ China no longer guarantees predictable landed cost

- ❌ Delays disrupt seasonal collections

- ❌ Compliance risk threatens brand reputation

They choose HCPLY – Vietnam Plywood because we are a direct manufacturer, supplier, and exporter with:

- ✔️ Stable birch plywood and poplar plywood production

- ✔️ Consistent thickness and surface quality for CNC processing

- ✔️ Factory-controlled core veneer systems

- ✔️ Long-term capacity planning

👉 Typical products for furniture brands:

- Birch plywood Vietnam

https://vietnam-plywood.com/birch-plywood-vietnam/ - Poplar plywood Vietnam

https://vietnam-plywood.com/poplar-plywood-vietnam/

For furniture brands, Vietnam is not cheaper — it is safer.

📦 Importers & Distributors: Risk Has Become Unmanageable

Importers operate on thin margins and high volume.

Any retroactive duty, customs delay, or documentation issue can erase profit from an entire container.

These buyers move fastest because:

- ❌ China’s duty environment destroys margin forecasting

- ❌ Inventory risk increases with each shipment

- ❌ Legal responsibility now sits with the importer

They work with HCPLY – Vietnam Plywood because:

- ✔️ Factory-direct pricing without trader layers

- ✔️ Stable documentation aligned with EU expectations

- ✔️ Predictable lead times and container planning

- ✔️ Flexible MOQ for diversified customer bases

👉 Common importer product mix:

- Poplar plywood

https://vietnam-plywood.com/poplar-plywood-vietnam/ - Packing plywood

https://vietnam-plywood.com/packing-plywood-vietnam/ - Film faced plywood

https://vietnam-plywood.com/film-faced-plywood-vietnam/

For importers, Vietnam restores control.

🏭 OEM Factories: Supply Continuity Is Non-Negotiable

OEM manufacturers supply other brands.

They cannot pass risk upstream.

They move because:

- ❌ China’s unpredictability breaks OEM delivery commitments

- ❌ Mixed quality batches disrupt downstream production

- ❌ Late shipments damage contractual trust

They partner with HCPLY – Vietnam Plywood because we provide:

- ✔️ Factory-scale consistency

- ✔️ Repeatable specifications across orders

- ✔️ Stable core composition

- ✔️ Export-grade panels designed for processing efficiency

👉 OEM-focused materials:

- Core veneer systems

https://vietnam-plywood.com/core-veneer-vietnam/ - Eucalyptus plywood for strength-focused use

https://vietnam-plywood.com/eucalyptus-plywood-vietnam/

🎯 The Common Pattern Behind Every Shift

Regardless of buyer type, the motivation is identical:

They are not chasing lower price.

They are eliminating uncontrolled risk.

All three buyer groups converge on HCPLY – Vietnam Plywood because:

- We are a large-scale plywood manufacturer

- We are a direct supplier without trading layers

- We are an experienced exporter to Europe

- We offer competitive pricing with long-term stability

In the next section, we will address the most common mistakes buyers make when leaving China, and why many fail in Vietnam by repeating the same sourcing errors under a different flag.

🔵 ⑨ Common Buyer Mistakes When Leaving China — And How to Avoid Repeating Them in Vietnam

Leaving China is only the first step.

Many European buyers fail after the move — not because Vietnam is wrong, but because they repeat the same sourcing mistakes under a different country name.

At HCPLY – Vietnam Plywood, a large-scale plywood manufacturer, supplier, and exporter, we see these errors repeatedly when buyers approach Vietnam without a factory-first mindset.

❌ Mistake 1: Choosing Vietnam — But Still Buying from Traders

The most common mistake is replacing Chinese traders with Vietnamese traders.

Buyers assume:

- “Vietnam supplier” = manufacturer

- “Factory address” = factory control

In reality, many suppliers in Vietnam are:

- ❌ Trading offices without production

- ❌ Aggregators sourcing from multiple small mills

- ❌ Unable to control core veneer, glue, or pressing

This recreates the same problems buyers faced in China:

- Inconsistent quality

- Mixed core structures

- Unstable compliance documentation

- No accountability when issues arise

HCPLY – Vietnam Plywood eliminates this risk by operating as a direct manufacturer, controlling production from core veneer to container loading.

❌ Mistake 2: Comparing Only FOB Price — Ignoring Landed Risk

Many buyers focus on:

- USD / CBM

- Quoted MOQ

- Short-term discounts

They ignore:

- Customs inspection delays

- Compliance exposure

- Rejected batches

- Retroactive duties

This leads to a false economy.

At HCPLY – Vietnam Plywood, buyers compare:

- ✔️ Stable landed cost

- ✔️ Predictable delivery

- ✔️ Documented compliance

- ✔️ Long-term contract viability

This is why our birch plywood and poplar plywood programs remain stable across multiple shipment cycles.

❌ Mistake 3: Misunderstanding Core Structure and Veneer Claims

Another critical error is trusting surface descriptions without verifying core structure.

Common issues include:

- “Birch plywood” with mixed, undocumented core

- “Poplar plywood” with variable density layers

- Inconsistent bonding performance between batches

As a factory-based exporter, HCPLY – Vietnam Plywood controls:

- Core veneer species and grading

- Layer composition and orientation

- Glue systems aligned with EU standards

👉 Factory-controlled core systems:

https://vietnam-plywood.com/core-veneer-vietnam/

This ensures buyers receive the same internal structure — not just the same face veneer.

❌ Mistake 4: Assuming All Vietnamese Factories Are the Same

Vietnam’s plywood industry is diverse.

Buyers often assume:

- All factories have export experience

- All factories understand EU standards

- All factories can support long-term contracts

This is not true.

Many mills focus on:

- Domestic markets

- Spot trading

- Low-spec production

HCPLY – Vietnam Plywood is different by design:

- ✔️ Export-first production mindset

- ✔️ European buyer experience

- ✔️ Stable capacity planning

- ✔️ Competitive pricing at factory scale

❌ Mistake 5: Switching Too Late — When Capacity Is Already Locked

The final mistake is timing.

European buyers often wait until:

- China risk becomes unmanageable

- Contracts are already disrupted

- Alternative capacity is limited

By then, reliable factory slots are already allocated.

Buyers who partner early with HCPLY – Vietnam Plywood secure:

- Production priority

- Specification stability

- Long-term pricing logic

🎯 The Key Lesson for European Buyers

Leaving China does not guarantee success.

Choosing the right manufacturing partner does.

European buyers who succeed in Vietnam:

- Work directly with factories

- Prioritize control over negotiation

- Value consistency over short-term price

- Plan for long-term supply, not emergency sourcing

This is why HCPLY – Vietnam Plywood has become a reference manufacturer, supplier, and exporter for European buyers transitioning away from China.

In the final section, we will connect this analysis to practical next steps, guiding buyers directly to birch plywood and poplar plywood product solutions designed for this new sourcing reality.

🔵 ⑩ Where Buyers Go Next — Practical Transition to Birch & Poplar Solutions from Vietnam

Understanding why buyers leave China is only half the journey.

The real question European buyers ask next is simple:

“Where do we go — and what products actually work at scale?”

At this stage, theory must turn into actionable sourcing paths.

This is exactly why HCPLY – Vietnam Plywood, as a large-scale plywood manufacturer, supplier, and exporter, structures its product portfolio not as isolated items — but as a connected solution system for buyers transitioning away from China.

🌳 Birch Plywood — The First Anchor for China Replacement

For buyers previously dependent on Chinese or Russian birch supply, the transition almost always starts here.

HCPLY – Vietnam Plywood manufactures export-grade birch plywood with:

- ✔️ Controlled core veneer structure

- ✔️ Stable thickness & sanding tolerance

- ✔️ EU-oriented glue systems

- ✔️ Factory-scale consistency for long-term programs

👉 Birch plywood Vietnam (factory-direct):

https://vietnam-plywood.com/birch-plywood-vietnam/

This is not a downgrade from traditional birch supply — it is a risk-stable replacement designed for European furniture, cabinetry, and interior brands.

🌲 Poplar Plywood — The Volume Engine After China

Once birch sourcing is stabilized, buyers immediately expand into poplar plywood for:

- Furniture components

- Interior panels

- Laminated boards

- OEM programs

HCPLY – Vietnam Plywood produces poplar plywood as a core product, not a low-end filler:

- ✔️ Plantation-based raw material

- ✔️ Lightweight, uniform density

- ✔️ High bonding reliability

- ✔️ Optimized container loading

👉 Poplar plywood Vietnam:

https://vietnam-plywood.com/poplar-plywood-vietnam/

For most European buyers, poplar plywood becomes the volume backbone of their Vietnam sourcing strategy.

🧩 Supporting Product Lines That Complete the Transition

To fully replace China-based supply chains, buyers typically integrate additional plywood categories from the same factory — avoiding fragmentation and risk duplication.

HCPLY – Vietnam Plywood offers a full export-ready portfolio:

- Core veneer systems (foundation of all panels):

https://vietnam-plywood.com/core-veneer-vietnam/ - Film faced plywood for regulated construction:

https://vietnam-plywood.com/film-faced-plywood-vietnam/ - Eucalyptus plywood for strength-focused applications:

https://vietnam-plywood.com/eucalyptus-plywood-vietnam/ - EV plywood for interior & decorative use:

https://vietnam-plywood.com/ev-plywood-vietnam/ - Packing plywood for logistics & industrial use:

https://vietnam-plywood.com/packing-plywood-vietnam/ - Okoume plywood:

https://vietnam-plywood.com/okoume-plywood-vietnam/ - Bintangor plywood:

https://vietnam-plywood.com/bintangor-plywood-vietnam/ - Gurjan plywood:

https://vietnam-plywood.com/gurjan-plywood-vietnam/ - Pine plywood:

https://vietnam-plywood.com/pine-plywood-vietnam/ - Matt plywood:

https://vietnam-plywood.com/matt-plywood-vietnam/ - Anti-slip plywood:

https://vietnam-plywood.com/anti-slip-plywood-vietnam/

📌 Why This Matters for European Buyers

The buyers who succeed after leaving China follow one rule:

They consolidate supply with real manufacturers — not scattered traders.

By working directly with HCPLY – Vietnam Plywood, buyers gain:

- ✔️ Factory-scale production capacity

- ✔️ Consistent specifications across product lines

- ✔️ Unified compliance documentation

- ✔️ Competitive pricing through manufacturing efficiency

- ✔️ Long-term supply continuity

🎯 Final Direction for Buyers

The China era ended because it became unpredictable.

The Vietnam era succeeds because it is manufactured, controlled, and export-driven.

European buyers who move decisively — and partner with real factories like HCPLY – Vietnam Plywood — do not just replace China.

They build a stronger, safer, and more scalable sourcing foundation for the next decade.

This is not a trend.

It is a structural shift — and it is already underway.

🔗 Internal Product Links — Clickable Factory Product Pages from HCPLY – Vietnam Plywood

To support European buyers moving directly from strategy to execution, below is a fully clickable internal linking system to HCPLY’s core product pages.

All links lead to factory-direct plywood products, manufactured, supplied, and exported by HCPLY – Vietnam Plywood — a leading Vietnam plywood manufacturer with large-scale capacity, stable quality control, and competitive export pricing.

🌳 Birch & Poplar — Core Products for China-to-Vietnam Transition

- 👉 Birch Plywood Vietnam – Factory Supplier & Exporter

Furniture-grade, CNC-ready, EU-compliant birch plywood produced at scale by HCPLY – Vietnam Plywood. - 👉 Poplar Plywood Vietnam – Lightweight & Volume Programs

Plantation-based poplar plywood optimized for furniture, interiors, and OEM applications. - 👉 Core Veneer Vietnam – Factory-Controlled Foundation

Controlled core veneer systems forming the backbone of all HCPLY plywood panels.

🧱 Construction, Industrial & Heavy-Duty Panels

- 👉 Film Faced Plywood Vietnam – Construction & Formwork

Export-grade film faced plywood manufactured for regulated construction markets. - 👉 Anti-Slip Plywood Vietnam – Flooring & Transport

High-performance anti-slip plywood for trailers, platforms, and industrial flooring. - 👉 Packing Plywood Vietnam – Industrial & Logistics Use

Cost-effective, stable packing plywood supplied directly from HCPLY factories.

🌲 Decorative & Structural Plywood Solutions

- 👉 Eucalyptus Plywood Vietnam – High Density & Strength

Heavy-duty plywood for load-bearing and strength-critical applications. - 👉 EV Plywood Vietnam – Interior & Decorative Panels

Export-grade EV plywood designed for interior furniture and paneling. - 👉 Okoume Plywood Vietnam – Furniture & Marine Look

Premium okoume-faced plywood manufactured for appearance-focused markets.

🌿 Face Veneer & Specialty Panels

- 👉 Bintangor Plywood Vietnam

Stable bintangor plywood supplied directly from factory production lines. - 👉 Gurjan Plywood Vietnam – Premium Face Veneer

Gurjan-faced plywood for buyers requiring strength and surface quality. - 👉 Pine Plywood Vietnam

Pine plywood manufactured for furniture, packaging, and interior applications. - 👉 Matt Plywood Vietnam – Finished Surface Panels

Matt-finished plywood for ready-to-use interior and decorative solutions.

🎯 Why This Internal Linking Structure Works

This clickable internal structure ensures that:

- ✔️ Buyers move seamlessly from education → product → inquiry

- ✔️ Google clearly recognizes HCPLY – Vietnam Plywood as a top Vietnam plywood manufacturer, supplier, and exporter

- ✔️ Every product page reinforces factory authority, scale, and compliance

- ✔️ The website functions as a single, connected sourcing ecosystem

This is how HCPLY – Vietnam Plywood positions itself not as a catalog — but as a long-term manufacturing partner for European buyers shifting away from China.