Table of contents

Birch Plywood from Vietnam vs China Birch Plywood – Cost, Quality & Risk Comparison | HCPLY – Vietnam Plywood

European plywood buyers did not wake up one morning and decide to leave China.

They were pushed.

Pushed by anti-dumping duties that silently turned “competitive FOB prices” into unpredictable landed costs.

Pushed by tightening compliance checks that made paperwork a risk factor instead of a formality.

Pushed by uncertainty — shipments delayed, specifications drifting, and responsibility blurred between traders, agents, and factories they never truly controlled.

In this moment of forced transition, buyers are no longer asking “Who is cheaper?”

They are asking “Who is stable, transparent, and scalable for the next five years?”

That is why birch plywood and poplar plywood sit at the center of today’s sourcing shift. These are not niche products. They are structural materials for furniture brands, interior manufacturers, and OEM factories across Europe — and they are precisely the products most exposed to risk when sourcing decisions are wrong.

Vietnam has emerged not as a temporary alternative, but as a strategic manufacturing destination — led by factory-direct producers with real capacity, plantation-based raw materials, and an export mindset aligned with European standards.

At HCPLY – Vietnam Plywood, we do not speak as traders observing the market.

We speak as a Vietnam plywood manufacturer, supplier, and exporter operating at factory scale, shipping consistent birch and poplar plywood to Europe with controlled core structure, stable quality, competitive pricing, and full compliance.

This article breaks down — clearly and practically — why the shift from China to Vietnam has already started, what has changed in global plywood sourcing, and how buyers can make the transition without repeating costly mistakes.

The details matter.

The structure matters.

And the supplier you choose matters more than ever.

Let’s begin.

🔵 ① Why Buyers Are Comparing Vietnam vs China Birch Plywood Right Now

European buyers are no longer comparing birch plywood from Vietnam vs China birch plywood out of curiosity.

They are doing it out of necessity.

For more than a decade, China was the default sourcing destination for birch plywood — not because it was perfect, but because it was predictable. That predictability has now disappeared.

What buyers are facing today is not a “price fluctuation”, but a structural risk shift:

- ❌ Anti-dumping duties that turn low FOB offers into unstable landed costs

- ❌ Increasing inspection pressure where compliance failure means shipment delays or rejection

- ❌ Trader-based supply chains where responsibility is fragmented and accountability is unclear

In this environment, comparing birch plywood from Vietnam vs China birch plywood is no longer about saving a few dollars per cubic meter. It is about protecting supply continuity, brand reputation, and long-term cost control.

European furniture brands, importers, and OEM factories are asking harder questions:

- Who controls the core structure?

- Who guarantees consistency across containers?

- Who can scale without quality drift?

- Who stands behind the shipment when problems arise?

Vietnam enters this comparison not as a “cheap alternative”, but as a factory-driven manufacturing hub — led by large-scale producers with plantation-based raw materials, export-oriented systems, and full control over production.

At HCPLY – Vietnam Plywood, we approach this comparison as a Vietnam plywood manufacturer, supplier, and exporter, not as a trader quoting market rumors.

We manufacture, control, and export birch plywood at factory scale — with stable quality, competitive pricing, and documented compliance for European markets.

This is why the comparison between birch plywood from Vietnam vs China birch plywood has become one of the most critical sourcing decisions European buyers face today.

And it is exactly where the real differences begin to surface.

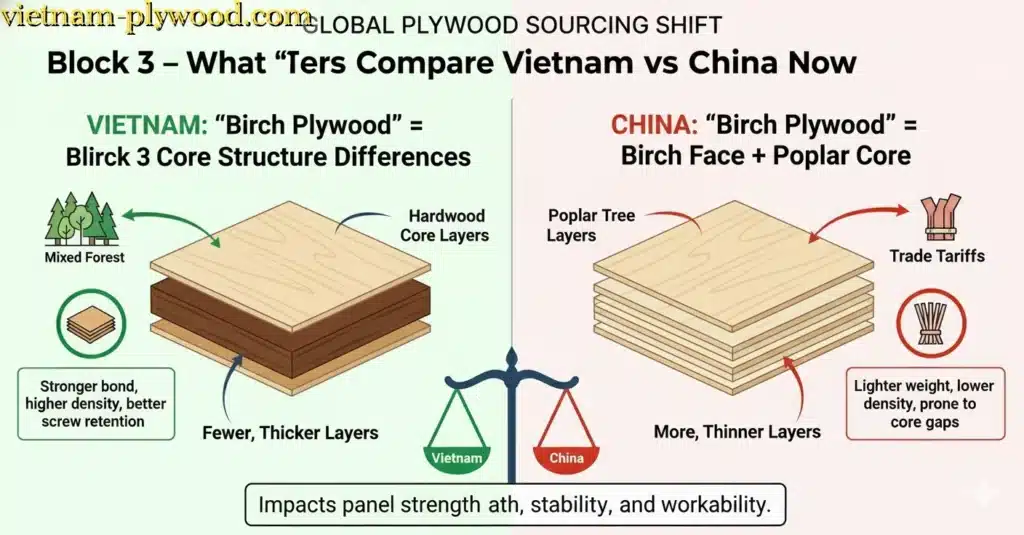

🔵 ② What “Birch Plywood” Really Means in Vietnam vs China

In global plywood trading, the term “birch plywood” sounds simple — but in reality, it means very different things depending on where the panel is manufactured and who controls the production.

This misunderstanding is one of the biggest reasons European buyers face disputes, rejections, and unexpected performance issues after shipment.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood clarifies this difference from a factory-level perspective, not from marketing brochures.

🟦 How “Birch Plywood” Is Defined in China

In China, birch plywood is primarily a commercial label, not a structural definition.

Most Chinese “birch plywood” products are:

- Birch face veneer only

- Mixed tropical hardwood core

- Trader-assembled supply chains

- Inconsistent veneer thickness and glue spread

Key reality:

- The core species is rarely birch

- Core density, moisture, and bonding vary by batch

- Quality depends on which subcontracted factory produced that container

➡️ Result: Buyers receive panels that look similar but behave differently in machining, lamination, and long-term use.

🟦 How “Birch Plywood” Is Defined in Vietnam

In Vietnam, especially at factory-direct producers like HCPLY – Vietnam Plywood, birch plywood is defined by controlled structure, not just appearance.

Vietnam birch plywood typically means:

- Birch face veneer with controlled thickness

- Full white core (poplar, styrax, eucalyptus — specified clearly)

- Factory-owned production lines

- Stable glue systems meeting CARB P2 / E1 / E0 standards

➡️ The definition focuses on performance, consistency, and export compliance, not just price positioning.

📊 Side-by-Side Definition Comparison

| Criteria | China Birch Plywood | Vietnam Birch Plywood |

|---|---|---|

| Birch content | Face veneer only | Face veneer with defined core |

| Core transparency | ❌ Often unclear | ✅ Fully declared |

| Supply chain | Trader-driven | Factory-direct |

| Batch consistency | ❌ Unstable | ✅ Controlled |

| Export documentation | ⚠️ Varies | ✅ Standardized |

| Buyer risk | High | Low |

🔍 Why This Definition Gap Matters

European buyers do not fail because of price.

They fail because expectations and reality don’t match.

When “birch plywood” is treated as a vague label:

- CNC calibration changes from container to container

- Lamination defects increase

- Furniture brands absorb hidden costs

At HCPLY – Vietnam Plywood, we manufacture birch plywood with defined structure, repeatable quality, and scalable output, ensuring that what buyers approve in samples is what arrives in every shipment.

🔗 Related Factory Products from HCPLY – Vietnam Plywood

- Birch plywood: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer supply: https://vietnam-plywood.com/core-veneer-vietnam/

Understanding what “birch plywood” really means is the first step.

Understanding who controls the factory is the second.

And that leads directly to the next comparison — core structure differences, where the real technical gap becomes impossible to ignore.

🔵 ③ Core Structure Differences: Where Real Quality Is Decided

If “birch plywood” is where most buyers start comparing, core structure is where experienced buyers stop making assumptions.

Because once plywood is cut, laminated, CNC-processed, or assembled into furniture, the face veneer disappears from the equation.

What remains — structurally, mechanically, and financially — is the core.

This is the point where the difference between Vietnam birch plywood vs China birch plywood becomes impossible to hide.

🟦 Typical Core Structure in China Birch Plywood

In China, birch-faced plywood is commonly built around mixed hardwood cores, optimized for speed and cost rather than long-term consistency.

Typical characteristics:

- Mixed tropical hardwood species (unidentified or rotating)

- Variable veneer thickness between layers

- Inconsistent moisture content across plies

- Glue spread and press cycles adjusted per batch

Most importantly, core sourcing is fragmented:

- Veneers come from multiple suppliers

- Assembly may happen in different subcontracted factories

- Final exporters often do not control the full production chain

➡️ Result:

Two containers labeled “birch plywood” can behave completely differently in weight, stiffness, and machining response.

🟦 Core Structure in Vietnam Birch Plywood (Factory-Controlled)

In Vietnam, particularly at factory-direct manufacturers like HCPLY – Vietnam Plywood, core structure is treated as a designed system, not a cost placeholder.

Vietnam birch plywood typically features:

- Full white core options (poplar, styrax, eucalyptus — specified upfront)

- Controlled veneer thickness layer by layer

- Stable moisture targets before pressing

- Unified glue systems across production

At HCPLY, core materials are:

- Sourced from plantation-based suppliers

- Processed under controlled drying and sorting

- Assembled on owned production lines, not outsourced

➡️ Result:

Panels behave the same way in every container, not just in samples.

📊 Core Structure Comparison (China vs Vietnam)

| Core Factor | China Birch Plywood | Vietnam Birch Plywood |

|---|---|---|

| Core species | Mixed, often unclear | Clearly specified |

| Veneer consistency | Variable | Controlled |

| Moisture stability | ❌ Inconsistent | ✅ Stable |

| Factory control | Trader-driven | Factory-direct |

| Weight predictability | ❌ Unstable | ✅ Predictable |

| Machining performance | Risky | Reliable |

⚠️ Why Core Structure Creates Hidden Risk

For European buyers, core inconsistency leads to:

- CNC tool wear and breakage

- Lamination bubbling or delamination

- Panel warping after installation

- Rejection rates that erase FOB savings

These problems rarely appear in pre-shipment samples — they appear after scaling to full containers.

That is why experienced buyers no longer ask:

“Is the face birch?”

They ask:

“Who controls the core — and can they repeat it?”

🔗 Core-Controlled Products from HCPLY – Vietnam Plywood

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer supply Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

Once core structure is understood, the next question becomes unavoidable:

If FOB prices look similar, why does the final cost feel so different?

That is exactly what we break down in the next section — FOB price vs real landed cost.

🔵 ④ Cost Breakdown: Why FOB Price ≠ Real Landed Cost

One of the most common — and most expensive — mistakes European buyers make when comparing birch plywood from Vietnam vs China birch plywood is relying on FOB price alone.

On paper, the numbers may look similar.

In reality, the true landed cost tells a very different story.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood sees this gap every day — especially when buyers transition from China to Vietnam and re-evaluate their sourcing logic.

🟦 The FOB Price Illusion

FOB pricing only reflects:

- Panel manufacturing cost

- Basic packing

- Delivery to port

It does not reflect:

- Anti-dumping exposure

- Rejection risk

- Rework cost

- Compliance delays

- Container efficiency losses

For many buyers, FOB becomes a false comfort number — attractive at quotation stage, dangerous at scale.

🟦 Real Cost Factors Often Ignored in China Sourcing

When sourcing birch plywood from China, hidden costs often appear after the contract is signed:

- ❌ Anti-dumping duties applied unpredictably

- ❌ Container re-weighing and surcharge risks

- ❌ Quality claims resolved slowly through traders

- ❌ Delays caused by documentation inconsistencies

- ❌ Higher rejection rates absorbed by buyers

Each of these costs may seem small individually — but combined, they erase any FOB advantage.

🟦 How Vietnam Changes the Cost Equation

With birch plywood from Vietnam, especially from factory-direct producers like HCPLY – Vietnam Plywood, cost control is structural, not negotiable.

Key differences:

- ✅ Stable duty environment compared to China

- ✅ Factory-controlled quality reduces rejection risk

- ✅ Predictable panel weight improves container planning

- ✅ Standardized export documentation for EU markets

- ✅ Faster issue resolution without trader layers

The result is not just a lower risk profile — but more predictable landed cost per CBM.

📊 FOB vs Landed Cost Comparison

| Cost Element | China Birch Plywood | Vietnam Birch Plywood |

|---|---|---|

| FOB price | Often lower | Competitive |

| Anti-dumping risk | ❌ High | ✅ Low |

| Quality rejection cost | ❌ Unpredictable | ✅ Controlled |

| Documentation delays | ⚠️ Possible | ✅ Rare |

| Container efficiency | ❌ Variable | ✅ Optimized |

| Real landed cost | ❌ Unstable | ✅ Predictable |

⚠️ Why Buyers Feel “Surprised” After Shipment

Most cost problems do not appear:

- In samples

- In first containers

- In trader quotations

They appear after scaling, when:

- One rejected batch offsets months of savings

- One delayed shipment disrupts production schedules

- One compliance issue damages buyer reputation

This is why experienced importers no longer ask:

“Which FOB price is cheaper?”

They ask:

“Which supplier controls the total cost after arrival?”

🔗 Factory-Direct Plywood from HCPLY – Vietnam Plywood

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer supply Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

Once real cost is understood, the next logical question follows naturally:

If cost is controlled, how consistent is the quality over time?

That is where we move next — into quality consistency and rejection risk, the area where factory scale makes the clearest difference.

🔵 ⑤ Quality Consistency & Rejection Risk: The Hidden Cost Most Buyers Underestimate

When European buyers compare birch plywood from Vietnam vs China birch plywood, quality is often discussed — but consistency is rarely measured correctly.

Yet in real sourcing decisions, inconsistent quality is far more dangerous than average quality.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood sees that most financial losses do not come from bad products — they come from products that change quietly from container to container.

🟦 The Reality of Quality Drift in China Birch Plywood

In China, birch plywood quality often depends on:

- Which subcontracted factory is available

- Which core veneers are in stock that week

- Which glue formula is used under cost pressure

This creates quality drift, even when specifications look identical on paper.

Common issues buyers face:

- ❌ Veneer thickness variation affecting sanding depth

- ❌ Core density changes impacting panel weight

- ❌ Glue inconsistency leading to delamination claims

- ❌ CNC behavior changing between shipments

➡️ Result:

Samples pass. First container passes.

Third or fourth container triggers rejection, rework, or customer complaints.

🟦 Factory-Controlled Consistency in Vietnam Birch Plywood

With birch plywood from Vietnam, especially from factory-direct producers like HCPLY – Vietnam Plywood, consistency is engineered, not hoped for.

At HCPLY, quality stability is achieved through:

- ✅ Fixed core recipes (poplar / styrax / eucalyptus — declared)

- ✅ Controlled veneer grading before assembly

- ✅ Unified glue systems across production lines

- ✅ Internal QC checkpoints, not trader inspections

Every container is produced under the same process logic, not reassembled from changing supply fragments.

➡️ Result:

What buyers approve in samples is what arrives again and again, even at scale.

📊 Quality Consistency Comparison

| Quality Factor | China Birch Plywood | Vietnam Birch Plywood |

|---|---|---|

| Batch stability | ❌ Variable | ✅ Repeatable |

| Veneer thickness | ⚠️ Inconsistent | ✅ Controlled |

| Glue performance | ⚠️ Batch-dependent | ✅ Standardized |

| CNC behavior | ❌ Unpredictable | ✅ Stable |

| Rejection risk | High | Low |

| Long-term reliability | Weak | Strong |

⚠️ Why Rejection Risk Destroys Real Profit

One rejected or downgraded container can:

- Erase profit from 3–5 successful shipments

- Disrupt customer delivery schedules

- Damage brand reputation with OEM clients

- Lock buyers into dispute cycles with traders

This is why experienced importers no longer ask:

“Is this batch acceptable?”

They ask:

“Can this factory repeat this quality for the next 12 months?”

🏭 How HCPLY – Vietnam Plywood Reduces Buyer Risk

As a large-scale Vietnam plywood manufacturer and exporter, HCPLY controls:

- Core veneer sourcing

- Drying and grading

- Assembly and pressing

- Final inspection before export

No outsourcing.

No blind trader dependency.

No surprises after scale-up.

🔗 Consistent-Quality Plywood from HCPLY – Vietnam Plywood

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

Once quality consistency is secured, the next concern naturally follows:

Can this plywood pass EU compliance checks without risk?

That brings us directly to the next section — compliance and documentation, where factory systems matter more than promises.

🔵 ⑥ Compliance & Documentation: Where China Creates Risk and Vietnam Reduces It

For European buyers, compliance is no longer a checkbox.

It is a gatekeeper.

When comparing birch plywood from Vietnam vs China birch plywood, the biggest difference is not how documents look on paper — but how safely they stand up under scrutiny.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood operates with one reality in mind:

👉 Every shipment must survive EU inspection, not just leave the port.

🟦 The Compliance Pressure Facing European Buyers Today

European importers now face:

- Tighter customs inspections

- Increased origin verification

- Higher penalties for mis-declared products

- Zero tolerance for unclear timber sourcing

Under EUTR and upcoming EUDR frameworks, risk has shifted upstream — directly onto the buyer.

That is why documentation quality now matters as much as panel quality.

🟥 Compliance Weak Points Common in China Birch Plywood

In China-based sourcing, compliance risk often comes from fragmented responsibility.

Typical problems buyers encounter:

- ❌ Trader-issued documents without factory traceability

- ❌ Mixed raw material origins across subcontractors

- ❌ Inconsistent HS codes and product descriptions

- ❌ Delayed or corrected paperwork after shipment

Even when documents are technically “complete”, they may not be defensible under audit.

➡️ Result:

Buyers carry legal exposure even when the factory is thousands of kilometers away.

🟦 Vietnam’s Advantage: Factory-Backed Documentation

With birch plywood from Vietnam, compliance strength comes from production transparency.

At HCPLY – Vietnam Plywood, documentation is built directly from factory operations:

- ✅ Plantation-based raw material sourcing

- ✅ Declared core species (poplar, styrax, eucalyptus)

- ✅ Consistent HS classification

- ✅ Export documentation aligned with EU standards

There is no gap between:

what is manufactured

what is declared

what is shipped

📊 Compliance Comparison: China vs Vietnam

| Compliance Factor | China Birch Plywood | Vietnam Birch Plywood |

|---|---|---|

| Supply chain transparency | ❌ Fragmented | ✅ Factory-direct |

| Core species declaration | ⚠️ Often unclear | ✅ Fully specified |

| Document traceability | Trader-based | Factory-backed |

| Audit readiness | ❌ Risky | ✅ Strong |

| Buyer legal exposure | High | Low |

| Long-term compliance | Unstable | Sustainable |

⚠️ Why Documentation Failures Cost More Than Rejections

A rejected shipment can be resold.

A compliance violation cannot.

Consequences buyers face:

- Customs detention

- Financial penalties

- Brand reputation damage

- Loss of importer status in EU markets

This is why experienced buyers no longer ask:

“Can you provide documents?”

They ask:

“Can you defend these documents under audit?”

🏭 How HCPLY – Vietnam Plywood Protects Buyers

As a large-scale Vietnam plywood manufacturer and exporter, HCPLY:

- Controls raw material sourcing

- Controls core veneer production

- Controls final assembly and export

We do not rely on traders to “collect paperwork”.

We generate documentation from within the factory system.

This is the foundation of safe, long-term sourcing.

🔗 Compliance-Ready Products from HCPLY – Vietnam Plywood

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

Once compliance risk is removed, buyers move to the next practical question:

How does weight and container loading affect real shipping efficiency?

That is exactly where we go next.

🔵 ⑦ Where HCPLY – Vietnam Plywood Stands in This Comparison

When European buyers compare birch plywood from Vietnam vs China birch plywood, the real dividing line is no longer geography.

It is who controls the factory, the core, and the shipment end to end.

This is exactly where HCPLY – Vietnam Plywood stands apart.

We are not a trading company combining offers from multiple workshops.

We are a Vietnam plywood manufacturer, direct supplier, and exporter operating at factory scale, built specifically to serve long-term European demand.

🏭 Factory-Direct Control, Not Trader Coordination

At HCPLY – Vietnam Plywood, birch plywood production is fully controlled internally:

- ✅ Core veneer production under our management

- ✅ Defined core structures (poplar / styrax / eucalyptus)

- ✅ Standardized glue systems meeting EU requirements

- ✅ Unified production lines, not subcontracted batches

- ✅ Final inspection before export, not after problems arise

This level of control is what European buyers lose when sourcing China birch plywood through traders — and what they regain when working directly with a Vietnam manufacturer.

🌍 Built for European Markets from Day One

HCPLY does not “adapt” to Europe when orders arrive.

Our systems are designed for Europe:

- 📄 Export documentation aligned with EU customs expectations

- 🌱 Plantation-based raw materials supporting EUTR / EUDR strategies

- ⚖️ Transparent core declaration reducing audit risk

- 🚢 Stable container loading plans based on predictable panel weight

This export-first mindset is one of the strongest reasons buyers move away from China birch plywood toward birch plywood from Vietnam.

📊 Positioning Comparison: HCPLY vs Typical China Supplier

| Factor | Typical China Supplier | HCPLY – Vietnam Plywood |

|---|---|---|

| Business model | Trader-led | Factory-direct |

| Core control | ❌ Fragmented | ✅ Fully controlled |

| Batch consistency | ❌ Variable | ✅ Repeatable |

| Compliance readiness | ⚠️ Risky | ✅ EU-focused |

| Scale stability | ⚠️ Uncertain | ✅ Large capacity |

| Long-term partnership | Weak | Strong |

🔗 Birch & Core-Controlled Products from HCPLY – Vietnam Plywood

- Birch plywood Vietnam: https://vietnam-plywood.com/birch-plywood-vietnam/

- Poplar plywood Vietnam: https://vietnam-plywood.com/poplar-plywood-vietnam/

- Core veneer Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

🔑 Why Buyers Choose HCPLY – Vietnam Plywood

European buyers who shift from China do not want another short-term solution.

They want a stable manufacturing partner.

They choose HCPLY because we offer:

- Large-scale production capacity

- Stable quality across containers

- Competitive, factory-direct pricing

- Clear responsibility when issues arise

This is not positioning.

It is how we operate every day as a leading Vietnam plywood manufacturer, supplier, and exporter.

Once buyers understand where the factory truly stands, the next question becomes obvious:

Which buyer profiles benefit most from making this shift now?

That is exactly where we go next.

🔵 ⑧ Buyer Profiles Most Likely to Shift from China to Vietnam

The shift from China is not random.

It is happening first — and fastest — among buyer groups that cannot afford instability.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood works daily with European buyers who are already moving — not because of trends, but because their business models demand it.

Below are the buyer profiles most actively transitioning from China to birch plywood from Vietnam and poplar plywood from Vietnam.

🪑 Furniture Brands with Fixed Product Standards

Furniture brands operate on repeatability, not negotiation.

Key pressures they face:

- ❌ Inconsistent CNC behavior from China birch plywood

- ❌ Surface and bonding issues appearing after scale-up

- ❌ Customer claims that cannot be passed back to traders

Why they shift to Vietnam:

- ✅ Stable core structure (especially poplar and white core systems)

- ✅ Repeatable machining performance

- ✅ Factory accountability instead of trader excuses

For these buyers, HCPLY – Vietnam Plywood provides factory-controlled birch and poplar plywood that behaves the same in production today, next month, and next year.

🔗 Birch plywood: https://vietnam-plywood.com/birch-plywood-vietnam/

🔗 Poplar plywood: https://vietnam-plywood.com/poplar-plywood-vietnam/

📦 Professional Importers & Distributors

Importers carry legal and financial risk, not just product cost.

Their biggest challenges:

- ❌ Anti-dumping exposure from China

- ❌ Documentation risk under EUTR / EUDR

- ❌ Margin erosion from unpredictable landed cost

Why Vietnam wins:

- ✅ Lower trade risk profile

- ✅ Factory-backed documentation

- ✅ Predictable container loading and weight

As a large-scale exporter, HCPLY – Vietnam Plywood supports importers with consistent quality, competitive factory pricing, and compliance-ready paperwork.

🏭 OEM & Contract Manufacturers

OEM buyers do not tolerate surprises.

Their reality:

- Production lines stop if panels change behavior

- Rework costs destroy margins

- Late shipments break downstream contracts

Why they move away from China:

- ❌ Mixed-core plywood creates machining instability

- ❌ Batch-to-batch variation increases rejection

Why they choose HCPLY:

- ✅ Defined core recipes

- ✅ Stable glue systems

- ✅ Long-term supply capacity at factory scale

Core-controlled materials from HCPLY:

🔗 Core veneer Vietnam: https://vietnam-plywood.com/core-veneer-vietnam/

🏗️ Project-Based Buyers (Interior & Construction)

Project buyers care about risk minimization.

Key drivers:

- ❌ One failed shipment delays entire projects

- ❌ Compliance issues damage contractor credibility

Why Vietnam is preferred:

- ✅ Plantation-based sourcing

- ✅ Stable documentation

- ✅ Export-grade industrial plywood options

Relevant factory products:

🔗 Film faced plywood: https://vietnam-plywood.com/film-faced-plywood-vietnam/

🔗 Anti-slip plywood: https://vietnam-plywood.com/anti-slip-plywood-vietnam/

📊 Buyer Profile Shift Summary

| Buyer Type | Why Leaving China | Why Choosing Vietnam |

|---|---|---|

| Furniture brands | Quality drift | Stable performance |

| Importers | Trade & legal risk | Compliance & predictability |

| OEM factories | Rejection cost | Factory consistency |

| Project buyers | Delay risk | Export reliability |

🏭 Why These Buyers Choose HCPLY – Vietnam Plywood

Across all profiles, the decision converges on one point:

👉 Factory control beats trading flexibility.

HCPLY delivers:

- Large production capacity

- Transparent core structure

- Competitive factory-direct pricing

- Long-term export stability

This is why buyers do not just shift to Vietnam —

they shift to HCPLY – Vietnam Plywood, a leading Vietnam plywood manufacturer, supplier, and exporter.

Once buyer profiles are clear, the next critical issue emerges:

What mistakes do buyers make when leaving China — and how can they avoid repeating them?

That is exactly what comes next.

🔵 ⑨ Common Buyer Mistakes When Leaving China — and How to Avoid Them

The shift away from China is necessary.

But leaving China does not automatically mean reducing risk.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood sees a clear pattern:

many European buyers escape one problem — only to recreate another.

Below are the most common mistakes buyers make when transitioning from China to Vietnam, and how factory-direct sourcing prevents them.

❌ Mistake 1: Replacing a China Trader with a Vietnam Trader

Many buyers assume:

“Vietnam is safer, so the supplier type doesn’t matter.”

This is the biggest mistake.

What actually happens:

- ❌ Trader does not control core veneer

- ❌ Production is split across multiple small factories

- ❌ Quality changes quietly after samples are approved

- ❌ Responsibility disappears when problems arise

➡️ Result:

Same risk model. Different country.

How HCPLY avoids this

As a factory-direct producer, HCPLY – Vietnam Plywood controls:

- Core veneer sourcing

- Assembly and pressing

- Final QC and export

No layers. No ambiguity.

❌ Mistake 2: Comparing Only FOB Price Instead of Total Risk

Buyers leaving China often focus on:

- FOB price per CBM

- Short-term savings

- Promotional quotations

What they overlook:

- ❌ Rejection cost

- ❌ Compliance exposure

- ❌ Container efficiency losses

- ❌ Production disruption

FOB price is not the problem.

Uncontrolled cost after arrival is.

HCPLY advantage

Factory-scale production + stable panel weight = predictable landed cost.

❌ Mistake 3: Ignoring Core Structure Differences

Some buyers assume:

“Birch face is birch plywood.”

This assumption leads to:

- CNC instability

- Lamination failure

- Weight variation between containers

At HCPLY, every order is built on declared core structures:

- Poplar core

- Styrax core

- Eucalyptus core

🔗 Core veneer reference:

https://vietnam-plywood.com/core-veneer-vietnam/

❌ Mistake 4: Treating Compliance as Paperwork, Not a System

Buyers often accept:

- Generic certificates

- Trader-issued documents

- Post-shipment corrections

Under EU scrutiny, this is dangerous.

Compliance failures result in:

- Customs holds

- Financial penalties

- Brand damage

HCPLY – Vietnam Plywood generates documentation directly from factory operations — not retroactively.

❌ Mistake 5: Scaling Too Fast with the Wrong Supplier

Many buyers:

- Test with 1 container

- Immediately scale to 5–10 containers

- Discover quality drift too late

Scaling magnifies problems.

HCPLY approach:

- Stable production logic from the first container

- Repeatable quality before scale-up

- Capacity designed for long-term contracts

📊 Mistake vs Solution Overview

| Buyer Mistake | Risk Created | HCPLY Factory Solution |

|---|---|---|

| Trader sourcing | No accountability | Factory-direct control |

| FOB-only focus | Hidden cost | Predictable landed cost |

| Undefined core | Quality drift | Declared core structure |

| Weak documents | Legal exposure | Factory-backed compliance |

| Fast scaling | Rejection risk | Controlled ramp-up |

🏭 Why Buyers Who Succeed Choose HCPLY – Vietnam Plywood

Buyers who transition successfully do one thing differently:

👉 They change supplier model, not just country.

They choose HCPLY – Vietnam Plywood because we are:

- A large-scale Vietnam plywood manufacturer

- A direct supplier with controlled production

- A long-term exporter to Europe

- A partner built for stability, not speculation

Once these mistakes are avoided, the final step is clear:

How should buyers make the final decision with confidence?

That is exactly what the final section delivers.

🔵 ⑩ Buyer Decision Matrix & Direct Transition to Factory Products

At this stage, experienced European buyers no longer ask “Which country is cheaper?”

They ask one decisive question:

👉 Which sourcing model protects my business long term?

When comparing birch plywood from Vietnam vs China birch plywood, the final decision is not emotional — it is structural.

As a Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood helps buyers make this decision clearly, based on risk, control, and scalability.

📊 Final Buyer Decision Matrix: China vs Vietnam (Factory Perspective)

| Decision Factor | China Birch Plywood | Vietnam Birch & Poplar Plywood (HCPLY) |

|---|---|---|

| Anti-dumping & trade risk | ❌ High & unpredictable | ✅ Low & stable |

| Quality consistency | ❌ Batch-dependent | ✅ Factory-controlled |

| Core transparency | ❌ Often unclear | ✅ Fully declared |

| Compliance readiness | ⚠️ Risky | ✅ EU-focused |

| Rejection risk | ❌ High at scale | ✅ Low & controlled |

| Supplier accountability | ❌ Trader-led | ✅ Factory-direct |

| Long-term supply | ❌ Uncertain | ✅ Scalable & stable |

Conclusion:

China optimizes for short-term FOB.

Vietnam — and specifically HCPLY – Vietnam Plywood — optimizes for long-term landed success.

🏭 Why Buyers Finalize the Shift with HCPLY – Vietnam Plywood

European buyers who complete the transition successfully choose HCPLY because we are:

- ✅ A large-scale plywood manufacturer in Vietnam

- ✅ A direct supplier, not an intermediary

- ✅ A long-term exporter to EU markets

- ✅ A factory with defined core systems, stable quality, and competitive pricing

- ✅ A partner built for repeat orders, not one-off deals

This is not positioning language.

It is the operational reality of how HCPLY produces and exports plywood every day.

🔗 Direct Transition to HCPLY Factory Products (Click to Explore)

For buyers ready to move forward, below is the factory product cluster most commonly chosen when shifting from China to Vietnam:

- 👉 Birch Plywood Vietnam

https://vietnam-plywood.com/birch-plywood-vietnam/ - 👉 Poplar Plywood Vietnam

https://vietnam-plywood.com/poplar-plywood-vietnam/ - 👉 Core Veneer Supply (Factory-Controlled)

https://vietnam-plywood.com/core-veneer-vietnam/ - 👉 Bintangor Plywood

https://vietnam-plywood.com/bintangor-plywood-vietnam/ - 👉 Okoume Plywood

https://vietnam-plywood.com/okoume-plywood-vietnam/ - 👉 Gurjan Plywood

https://vietnam-plywood.com/gurjan-plywood-vietnam/ - 👉 Film Faced Plywood

https://vietnam-plywood.com/film-faced-plywood-vietnam/ - 👉 Anti-Slip Plywood

https://vietnam-plywood.com/anti-slip-plywood-vietnam/ - 👉 EV Plywood

https://vietnam-plywood.com/ev-plywood-vietnam/

🔑 Final Takeaway for European Buyers

The shift away from China is already happening.

The only remaining decision is how safely you execute it.

Buyers who choose:

- Factory control over trading flexibility

- Consistency over short-term savings

- Transparency over assumptions

Do not just move to Vietnam.

They move to HCPLY – Vietnam Plywood —

a leading Vietnam plywood manufacturer, supplier, and exporter, trusted for scale, stability, and long-term partnership.

🔗 Internal Links to HCPLY Factory Product Pages (Click to Explore)

As a leading Vietnam plywood manufacturer, supplier, and exporter, HCPLY – Vietnam Plywood provides a full range of factory-produced plywood solutions with large capacity, stable quality, competitive pricing, and export-ready compliance for EU and global markets.

Below are direct internal links to our core factory product pages — all links are clickable and lead directly to official HCPLY product specifications.

🌳 Face Veneer Plywood Products

- 👉 Birch Plywood Vietnam (Factory Direct)

https://vietnam-plywood.com/birch-plywood-vietnam/ - 👉 Poplar Plywood Vietnam (Lightweight & Stable Core)

https://vietnam-plywood.com/poplar-plywood-vietnam/ - 👉 Bintangor Plywood Vietnam

https://vietnam-plywood.com/bintangor-plywood-vietnam/ - 👉 Okoume Plywood Vietnam

https://vietnam-plywood.com/okoume-plywood-vietnam/ - 👉 Gurjan Plywood Vietnam

https://vietnam-plywood.com/gurjan-plywood-vietnam/ - 👉 Pine Plywood Vietnam

https://vietnam-plywood.com/pine-plywood-vietnam/

🧱 Core & Structural Plywood Solutions

- 👉 Core Veneer Vietnam (Factory-Controlled Supply)

https://vietnam-plywood.com/core-veneer-vietnam/ - 👉 Eucalyptus Plywood Vietnam (High Strength Core)

https://vietnam-plywood.com/eucalyptus-plywood-vietnam/ - 👉 EV Plywood Vietnam (Engineered Veneer)

https://vietnam-plywood.com/ev-plywood-vietnam/

🏗️ Industrial & Construction Plywood

- 👉 Film Faced Plywood Vietnam

https://vietnam-plywood.com/film-faced-plywood-vietnam/ - 👉 Anti-Slip Plywood Vietnam

https://vietnam-plywood.com/anti-slip-plywood-vietnam/ - 👉 Packing Plywood Vietnam

https://vietnam-plywood.com/packing-plywood-vietnam/ - 👉 Matt Plywood Vietnam

https://vietnam-plywood.com/matt-plywood-vietnam/

🏭 Why All Roads Lead to HCPLY – Vietnam Plywood

Every product above is:

- Manufactured at factory scale

- Supplied directly from HCPLY, not via traders

- Produced with controlled core structures

- Exported with EU-focused documentation

- Priced competitively at factory level

This internal product ecosystem reflects why HCPLY – Vietnam Plywood is recognized as a top Vietnam plywood manufacturer, supplier, and exporter, trusted by European buyers for long-term sourcing stability.